PNB MetLife Graduate Development Program

in collaboration with MentorKart ®

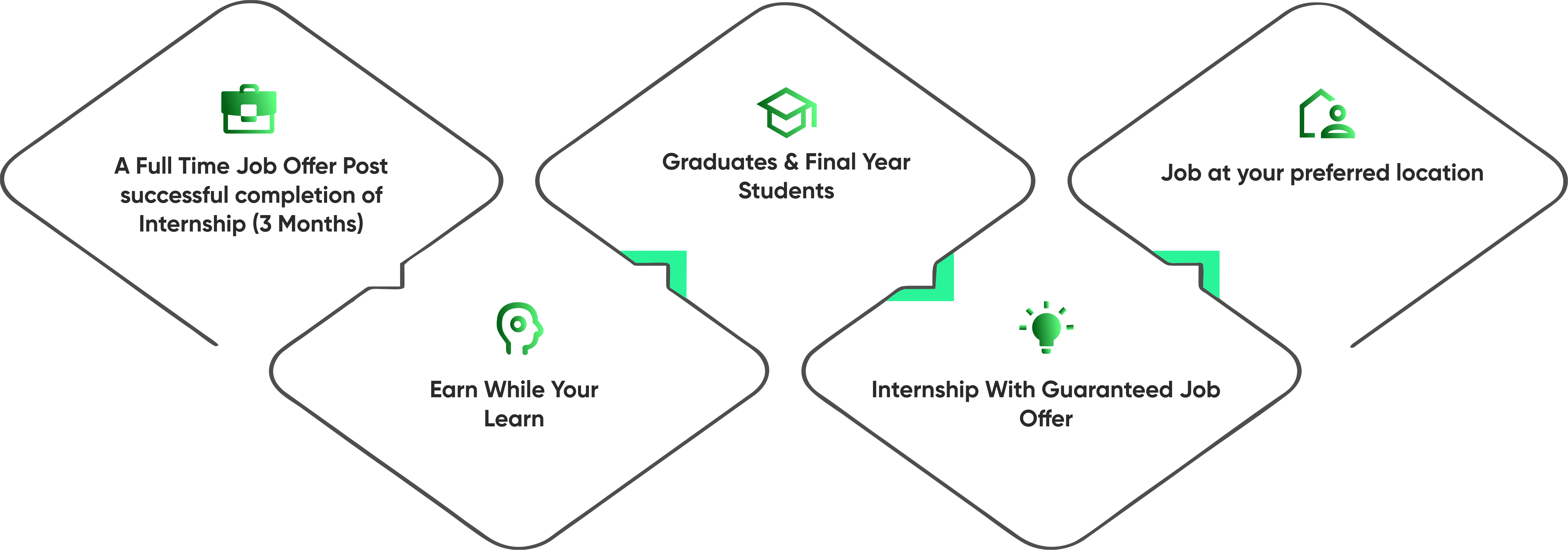

Guaranteed Internship

Soft skills training

Guaranteed jobs*

120 hrs of Training

Industry certification

Combination of Live Class + Offline Internship

* Based on performance, internship feedback and tenure

1 Month Training +

3 Months Internship (Stipend ₹10,000/month)

Batch starting from

Coming Soon

Fixed Salary ₹ 2.4 LPA+ Incentives*

PNB Metlife Internship with guaranteed job offer*

How to Enroll in the Program

Complete your Enrollment Process

Read the details about the program and download the brochure by registering.

Give your Assessment and Screening Interview

Clear an assessment and screening interview to land up a Internship

Start your Internship

On clearing screening interview, join Graduate Development Program for a month. Clear all tests of program to land up in Internship of 3 Months.

Get a Full Time Job

Complete your Training + Internship and earn a good feedback to get a full time employment

Limited Seats Hurry Up!!

Book your seat now

Name

Email ID

Phone Number

Current City

About PNB MetLife

PNB MetLife India Insurance Company Limited (PNB MetLife) is one of the leading life insurance companies in India (Source – CRISIL), has as its shareholders MetLife International Holdings LLC (MIHL), Punjab National Bank (PNB), M. Pallonji and Company Private Limited, Jammu & Kashmir Bank Limited (JKB), and other investors, with MIHL and PNB being the promoters of the Company. PNB MetLife has been present in India since 2001.

PNB MetLife brings together the financial strength of a leading global life insurance provider, MetLife, Inc., and the credibility and reliability of PNB, one of India's oldest and leading nationalized banks. The vast distribution reach of PNB together with the global insurance expertise and product range of MetLife makes PNB MetLife a strong and trusted insurance provider. PNB MetLife follows ‘Circle of Life’ philosophy for products and solutions and caters to financial requirements of customers covering their 4 different stage of life- Child Education, Family Protection, Long Term Saving and Retirement. Our comprehensive product portfolio comprises of 25 Retail and 14 Group Products and riders catering to the various needs.

Details about this Program

This program is designed in collaboration with PNB Metlife for the recent graduates who want to start their career in field of Insurance at their native locations or nearby. In this program you will be provided with internship first and in parallel you will be completing the PNB Metlife Graduate Development Program and will get the role of Relationship Manager. Post completion of internship, PNB MetLife will offer you a full time job in their PNB Bancassurance channel

Eligibility: Graduates & Final Year Students with passion to work in Insurance Sector

Batch starts from: Coming Soon

Internship Period: 3 Months

Internship Stipend: ₹10000/Month

Program Fee Structure

₹ 20000

When you start an internship with PNB Metlife, you will be required to pay partial course fee of ₹20,000, payable in three monthly installments(A sum of ₹2000 will be charged for blocking your seat.)

₹6,666/ Month for 3 Months

Payable once you get selected for the Internship

₹ 30000

Pay rest ₹30,000 in installments, which can be divided into three, nine, and twelve months installments.

₹ 10,000/ Month for 3 Months or ₹3,333/ Month for 9 Months or ₹2,500/ Month for 12 Months

Payable only after you get a full time position

**All payments for this program to be made to MentorKart only

Why choose this Program???

Are you still confused? whether to choose this program or not Below are following pointers which will help you to decide

How will this Program work ?

Eligibility:

Graduates & Final Year Students

Program Duration:

4 Months

Internship Stipend:

INR ₹10,000 Per Month for 3 Months

Pay After Placement

Completer your Internship successfully and get a Full Time Job

Salary:

INR ₹ 2.4 LPA + Incentives

Meet our Lead Mentor

DINKAR CHOPRA

Director, Insiqa Technologies and Ex-PNB MetLife

Dinkar Chopra thinks strategically about business and market opportunities.Proven leadership abilities supported by an entrepreneur spirit and risk-taking appetite.

A hustler with an impeccable record of executing Go To Market Strategies. Successfully delivered results in diverse industries like FMCG,BFSI,Food,Ed-Tech,IoT,SaaS,ERP Solutions, Security Tech etc. Manage Omni-Channel platforms like B2B,B2B2C,B2C, Modern Trade,CSD,Govt-Entities, Distributors,Stockists,Agents,Advisors etc. Manage Product life-cycle.Transform business trends into long term strategic growth plans.

About Pay After Placement

Pay after placement (PAP) is the red-carpet way to land your dream job. The PAP program structure is specially designed to assist you with learning skills relevant to industry requirements. This initiative is specially launched to clear all the hurdles students face to achieve success.

The program will begin from the roots so that you will learn about Insurance sector. All you need to have is a sincere commitment to learning, and we assure you will succeed in your career.

Under the Pay after Placement model by MentorKart, you will get a Internship or Full-Time Job or Both, post which you will have to pay a certain amount (No Interest EMI options available) to MentorKart as program fees. Pay after placement (PAP) is the red-carpet way to land your dream job. The PAP program structure is specially designed to assist you with learning skills relevant to industry requirements. This initiative is specially launched to clear all the hurdles students face to achieve success. Under the PAP scheme, the student need not pay the fee until they get their first salary.

What will I learn in this Program?

Learning common etiquettes and practicing them through role-plays and activities.

Handling business cards, understanding general meeting etiquettes, and practicing them through role-plays and activities

Developing telephone etiquettes and practicing them through role-plays and activities

Understanding grooming standards and power dressing

Identifying the elements of good and bad customer service, exploring moments of truth in customer service

Developing complaint management and service recovery skills

Understanding customer relationship management (CRM)

Learning about benchmark practices in CRM and practicing through role-plays.

Developing the ability to work under pressure.

Improving negotiation skills

Understanding the importance of interpersonal activities

Developing the ability to think creatively and out of the box

Basic grammar rules for spoken English, including verbs, conjunctions, and prepositions

Guidelines for email writing and email etiquettes

Identifying word parts such as roots, prefixes, and suffixes, and building business vocabulary

Strategies for delivering effective presentations

Improving active listening skills and paraphrasing

Developing English speaking skills through self-introduction and impromptu speeches

Tips for having effective conversations in English

Participating in group discussions to improve communication and interpersonal skills

Mentorkart Mentorship Program

Understanding the relationship between sales and relationship management

Learning financial selling techniques and AIDA (Attention, Interest, Desire, and Action) model

Exploring insurance distribution channels

Understanding the sales profile and personality fitment

Conceptualizing the sale process and the big picture

Learning about different sales types and personality traits

Identifying the personality types of successful sales professionals

Improving negotiation skills

Developing closing techniques to secure orders

Understanding order management, including up-selling and cross-selling

Learning consultative selling techniques, including need identification, recognizing the M.A.N (Money, Authority, Need), developing general benefit statements, using the FAB (Features, Advantages, Benefits) technique, handling objections, and up-selling and cross-selling

Practicing through activities and role-plays

Sales Pipeline: The bigger the pipeline, the better your output

Course Overview

Get Graduate Development Program by learning from Industry Experts

Online Classes + Offline Internship

Interact and Learn from successful Mentors, industry leaders from some of the top corporate.

The successfull candidates will get a real life exposure by working as an intern at the local centers of PNB Metlife and its affiliate and post internship they will be offered a full time role.

Guest Lectures

Listen from industry stalwarts. The industry leader will guide you, and you can learn how to bring this culture more intensively.

Case Studies

It is tough to succeed at case interviews without proper preparation. Solve some exciting case studies and learn excellent preparation resources to practice.

Industry Experts who’ll teach you

Tarun Kumar Singh

AIII, CRICP, CIAFP

Kanahiya Manuja

Commercial Account Manager

Abhaya Gupta

Sales Coach

Chumki Chopra

Strategic Account Management & Sales Excellence

Tanvi Bhasin

Learning and Development Professional

Get the certificate

This is a sample certificate provided post successful completion of the program to each individual. PNB Metlife graduate development program certification will be provided jointly by MentorKart and PNB Metlife with lifetime validity

This certificate can help you to accelerate your career in insurance sector as this program is a tailored made program for graduates by Industry mentors and veterans

Certificate will be awarded on course completion

Frequently asked questions(FAQs)

Total Course Fee Is ₹ 50,000 But It Will Be Divide In Two Parts That Is ₹ 20,000 Once You get selected for Course + Internship With PNB Metlife And ₹ 30,000 Once You Get A Full Time Job Offer.

Please call us on+91 7905242107or submit your detailshereto get a call back and communication for further steps.

Graduates & Final Year Students with passion to work in Insurance Sector

The Internship will be of 3 Months and you will be getting a stipend of ₹ 10,000 Per month

If you are offered a full-time position, you would be eligible to earn a base salary of ₹ 2.4 LPA along with incentives.

You will learn and improve your communication skills, how to - increase customer retention, enhance networking opportunities, improve conflict resolution, and develop leadership skills. Overall, the program can provide you with the skills and tools you need to build and maintain strong relationships with customers, colleagues, and stakeholders, which can lead to long-term business growth and personal development. The specific ways in which this program can help you grow will depend on the program's focus and objectives. However, generally speaking, participating in a program can provide you with new knowledge, skills, and experiences that can contribute to both your personal and professional growth.

During the training and internship period, it may be possible for you to discontinue the program before its completion. However, after accepting the offer letter for a full-time position, it is generally expected that you fulfill your obligations and do not terminate your employment prematurely.

Once the amount paid, it will not be refunded as perMentorKart Refund Policy.

Yes, Certificate will be provided after completion of the training.

Yes, subject to approval by our financing partner

Limited seats, Apply now! Or call on +91 7905242107